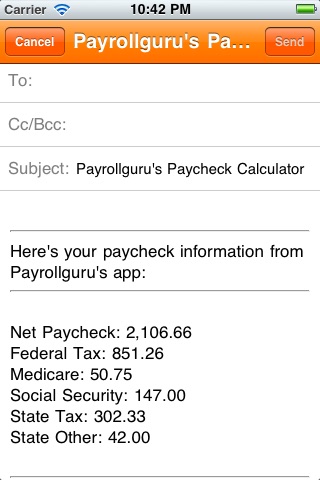

Paycheck Calculator calculates net pay (take-home) amount and applicable taxes from gross wages.

Calculated taxes include:

- Federal Withholding,

- Social Security,

- Medicare,

- State Withholding,

- State Disability Insurance (where applicable),

- State Unemployment Insurance (where applicable).

State tax calculations are available for all 50 states (US) and District of Columbia.

Paycheck Calculator assumes that you enter proper federal exemption and state exemptions. Rule of thumb is to enter 1 for yourself and add another 1 for each additional dependant in your household. Paid wages (year-to-date) are assumed to be 0, therefore a minor descrepancy with your actual paycheck is expected at the end of the year.

To produce the most accurate paycheck calculation please upgrade to Payrollguru app, that considers the number of allowances and paid year-to-date wages, and allows for additional pre-tax and post-tax deductions.

Paycheck Calculator can be used by employees and employers in the US to verify accuracy of actual paychecks. Can email result to any person.

Great tool to compare take-home amounts after taxes in different states and/or in different pay scenarios, such as married vs. single, weekly vs. monthly. Helps to plan your budget and future spending.

Enjoy using it and please review it the app if you like it.